Exness Leverage: Unlimited Trading Potential

Take control of your trades with the right leverage! Adjust your Exness leverage now.

What is Exness Leverage?

Leverage is a tool that allows traders to control a larger position in the market with a smaller amount of capital. In simple terms, it acts like a magnifying glass for your trading, amplifying both potential profits and potential losses. Exness, a globally recognized broker, offers various leverage options to suit different trading strategies and risk appetites. By understanding how leverage works in Exness, traders can better manage their positions and optimize their trading potential.

Ready to maximize your trading potential? Explore Exness leverage options in India today!

Key Features of Exness Leverage

- Flexibility: Choose from various leverage levels depending on your trading style and risk tolerance.

- Accessibility: Available to both new and experienced traders on different account types.

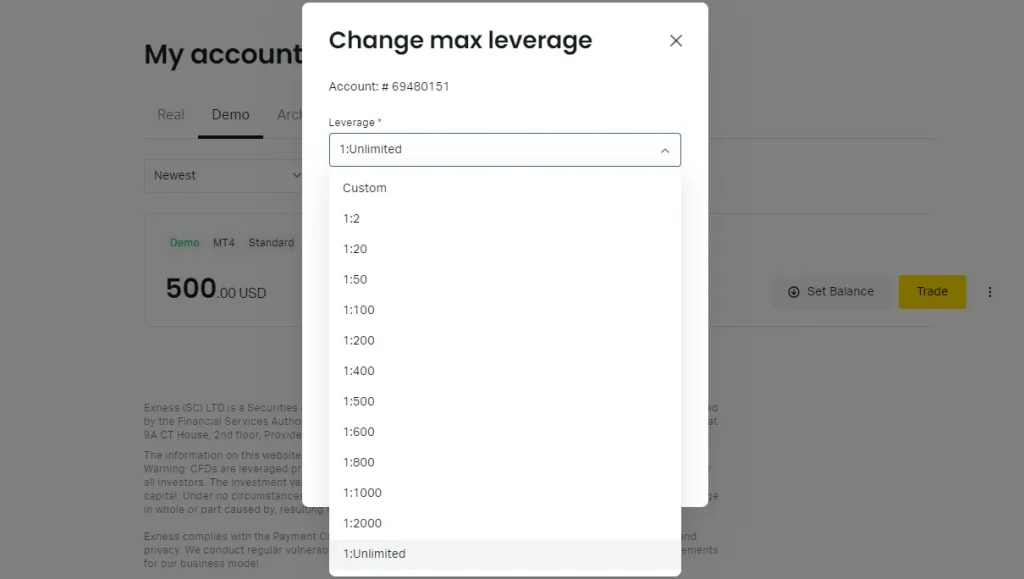

- Scalability: Leverage options range from 1:2 up to unlimited leverage, depending on the account and instrument.

Feature | Details |

Leverage Levels | 1:2 to Unlimited |

Account Types | Standard, Raw Spread, Zero, Pro |

Instruments Available | Forex, Metals, Cryptocurrencies, Energies, Stocks |

Risk Management Tools | Margin calls, stop out levels, negative balance protection |

Requirements | Vary based on account type and leverage level chosen |

Benefits and Risks of Using Exness Leverage

Benefits of Exness Leverage:

- Amplified Profits: With higher leverage, even small market movements can result in significant gains.

- Lower Capital Requirement: Allows trading larger positions with less initial investment.

- Diversification: Use leverage to diversify your portfolio without tying up a large amount of capital.

Risks of Exness Leverage:

- Amplified Losses: Just as profits can be magnified, so can losses. Trading with high leverage carries a high level of risk.

- Margin Calls: If the market moves against your position, you may receive a margin call, requiring additional funds to maintain the position.

- Volatility Sensitivity: Leverage can increase sensitivity to market volatility, making positions more susceptible to rapid changes.

Choosing the Right Leverage Level with Exness

Selecting the appropriate leverage level is crucial for effective trading. Here are some factors to consider:

- Trading Experience: Beginners should start with lower leverage to understand market dynamics without excessive risk.

- Risk Tolerance: Assess your comfort level with potential losses. Higher leverage increases both risk and reward.

- Market Conditions: Volatile markets may require lower leverage to manage risk effectively.

- Account Balance: Your account size should influence your leverage choice. A smaller account might not withstand high leverage.

Leverage Recommendations:

Experience Level | Suggested Leverage |

Beginner | 1:2 to 1:50 |

Intermediate | 1:50 to 1:200 |

Advanced | 1:200 to Unlimited |

How to Change Leverage on Exness: A Simplified Guide

Optimize your trading with the right leverage. Adjust your settings on Exness now! Quick Steps to choose Leverage on Exness:

1. Login and go to Account Settings:

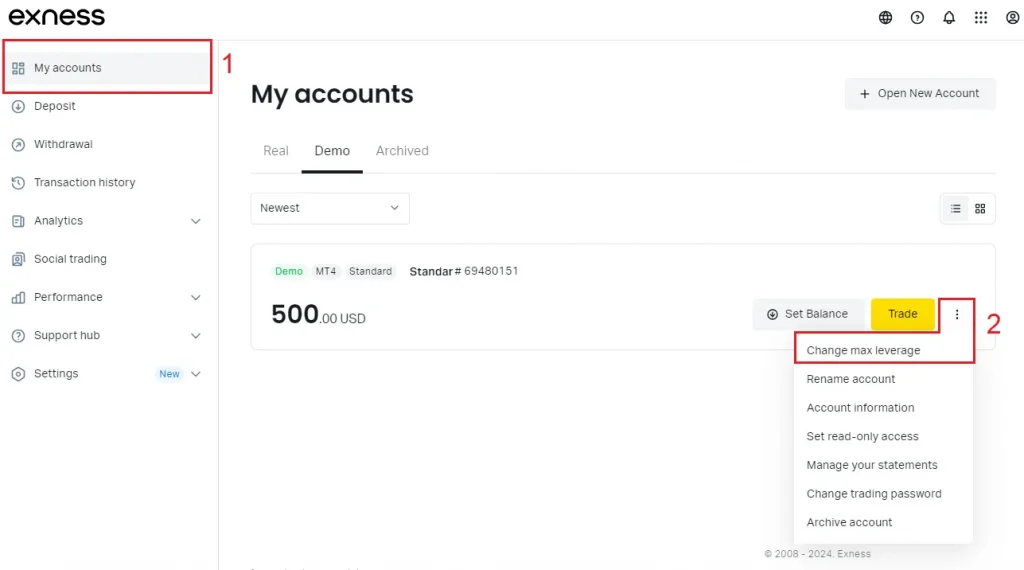

After logging in, navigate to the ‘Account’ or ‘My Accounts’ section. This area allows you to manage and customize your account settings.

2. Select Account:

If you have more than one trading account, choose the account you want to modify by clicking on it.

3. Find Leverage:

In the account details, look for the ‘Leverage’ option. This is where your current leverage settings are displayed.

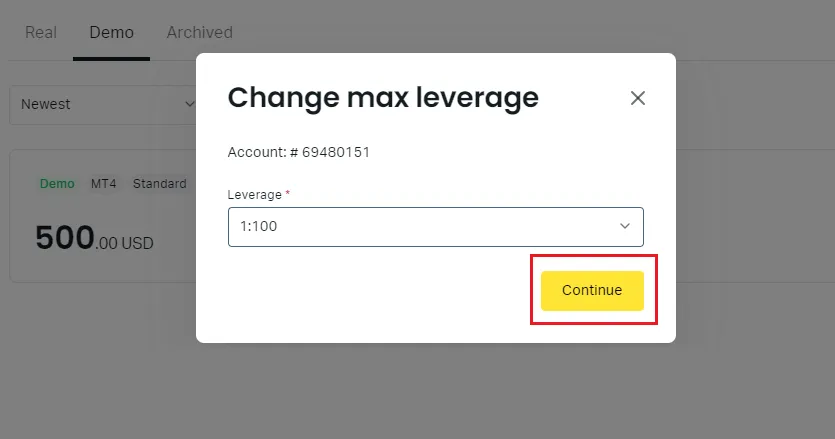

4. Change Leverage:

Click on the current leverage setting to see available options. Choose your desired leverage ratio and confirm your selection.

5. Restart if Needed:

If you don’t see the changes immediately, log out of your account and log back in or restart the platform to update the settings.

An Example of How Exness Leverage Works

Imagine you have $1,000 in your Exness trading account and you decide to trade EUR/USD. Without leverage, you can only open a position worth $1,000. However, by using leverage, you can control a much larger position.

For example, if you choose a leverage ratio of 1:100, your $1,000 can control a position worth $100,000 ($1,000 x 100). This means that even a small price movement in the EUR/USD pair can lead to significant profits—or losses. If the EUR/USD moves 1% in your favor, your profit would be $1,000, effectively doubling your initial investment. However, if the market moves 1% against you, you would lose your entire $1,000.

This example highlights the power of leverage: it amplifies both potential gains and potential risks. Therefore, it’s crucial to choose a leverage level that aligns with your trading strategy and risk tolerance.

Strategies for Effective Leverage Management

To maximize the benefits of leverage while managing risks, consider these strategies:

- Use Stop-Loss Orders: Protect your capital by setting predefined exit points to limit potential losses.

- Diversify Your Trades: Spread your risk by trading different instruments and not over-leveraging a single position.

- Regularly Monitor Positions: Keep a close eye on your leveraged trades to respond quickly to market changes.

- Stay Informed: Continuously update your market knowledge and adjust your strategies as needed.

Boost your trading strategy — choose the perfect leverage level with Exness!

User Reviews and Opinions on Exness Leverage

Exness traders have varied experiences with leverage. Here’s a compilation of user feedback:

- Pros: Many users appreciate the flexibility of leverage options, particularly the ability to choose levels that align with their trading strategies and risk management.

- Cons: Some traders caution against using high leverage without a solid understanding of the market, as it can lead to significant losses.

User Testimonials:

- “Exness offers great leverage flexibility. I started with low leverage to learn and gradually increased it as I became more confident.” – John D.

- “High leverage can be risky if you’re not careful. It’s important to use it wisely and not get carried away.” – Sarah L.

Conclusion

Understanding and using leverage effectively is key to maximizing trading opportunities with Exness. By choosing the right leverage level, employing sound risk management strategies, and staying informed, traders can harness the power of leverage to enhance their trading performance while managing risks effectively.

FAQ

What is the maximum leverage offered by Exness?

Exness offers leverage up to 1:2000 on some account types, with unlimited leverage available under specific conditions.

How does Exness ensure safe trading with high leverage?

Exness provides several risk management tools, including margin calls, stop-out levels, and negative balance protection, to help traders manage the risks associated with high leverage.

Can I change my leverage level after opening an account?

Yes, traders can adjust their leverage levels at any time through the Exness platform settings, depending on their account type and trading needs.

Is there any difference in leverage between demo and real accounts?

Leverage settings can be applied to both demo and real accounts, allowing traders to practice with different levels before trading with real funds.